Old Capital Podcast had a conversation with multifamily experts about the current economic outlook for multifamily assets and how COVID-19 impacts multifamily investing. They discuss the differences between the 2008 financial crisis and the current COVID-19 economic crisis, what is happening in the Texas and national market, what multifamily investors should currently be doing, and much more. A couple of guests on the show were Michael Becker, owner of 6,000+ multifamily units in Texas, John Chang, national director of research with Marcus & Millichap, and Nick Fluellen, a multifamily broker with Marcus & Millichap .

The Financial Crisis v. The Current COVID-19 Economic Crisis

- 10 years of job creation in this cycle. Almost 3x the number of jobs were created in this cycle than last cycle.

- Household income is 25% higher than it was going into the last cycle and household debt is currently drastically lower. Households are in a much better financial position going into this crisis than the financial crisis.

- The global financial crisis was derived from financial institutions and the stimulus packages were implemented a lot slower. Also, most of the stimuli purpose was to save institutions.

- The current COVID-19 crisis is a health driven crisis. Banks, companies, and people are in a much better position, economically speaking, than during the financial crisis.

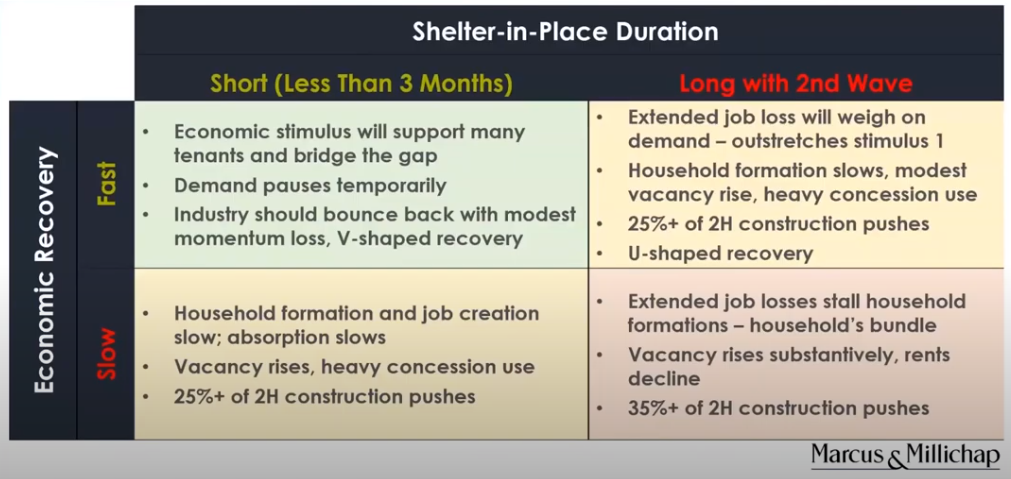

- The impact on multifamily assets will vary with length of shelter in place and economics recovery pace. Below is a visual that outlines the possible impacts on the economy.

What’s Happening in The National Multifamily Market?

- From January to March, Nick’s investment sales team at Marcus & Millichap closed 17 deals. It was the best start of the year for Nick’s team in 16 years. From March to May they had a handful of deals fall through and 5 deals that are currently in escrow. When will more deals be entering the market? Nick’s indicators are:

-

- When will we turn back on the economy?

- How quickly will people be hired that are currently unemployed?

- Figuring out if this will be a V shaped or U shaped recovery?

- Most A and B class multifamily assets across the US had a 5% to 8% collection loss. Collection loss was lowest in the Midwest (around 3%-5% collection loss).

- There will be a small increase in vacancy across the board and even if vacancy increases by 4 to 5% we will still nationally be at an 8 to 9% total vacancy rate

- Transaction volume will remain very low over the next 2 to 3 months

- Asset value will decrease a little, there will be less buyers, but there are still tons of capital in the marketplace

The most important things multifamily owners are doing right now are:

- Being up front with their employees and letting them know what the company’s game plan is going to be

- Communicating with their tenants

- Staying in contact with their lender

- Talking with their investors and making sure they are not blind sided with a much smaller dividend check

- Communicating with their investment sales broker

What a 6,000 Unit Multifamily Investor Is Currently Seeing and Doing

- As of April 15th, Michael Becker’s 6,000 units in Dallas and Austin have collected 94% of rents

- Seeing class A- assets collect around 95%, class B is 93% collected, and class C is 90% collected

- Stopped paying distributions to investors monthly and now paying out quarterly

- Stopped all unit upgrades and exterior projects

- Trying to keep tenants during the renewal process by keeping rent the same or even decreasing it

Who Should Listen?

If you are a current multifamily investor and want to know how COVID-19 impacts multifamily investing, I would give this podcast episode a listen. The panel of experts provide great macro/micro insight on how multifamily assets are performing and how they will perform over the next 18 months. If you enjoyed this podcast recommendation and want to receive future weekly podcast recommendations like this, then get free access here!