Internal Rate of Return (IRR) and Net Present Value (NPV)

Internal Rate of Return (IRR)– is one way to measure the performance of an investment in a real estate transaction that spans across multiple periods

- It is an annualized rate of return expressed as a percentage

- If the investment spans only 12 months, the IRR is the same as the overall return on that cash investment (which is the “cash on cash return”)

- IRR in real estate is a cumulative measurement. It reflects the average annual return generated on your investment

Net Present Value (NPV)– is a way to account for all future cash flows from an investment and discount the future cash flows to what they would be worth in the present day. The NPV being positive is an indicator that the investment will be profitable.

- The discount rate represents the time value of money

- If NPV was $8,881.52, we know that the investment is creating $8,881.52 in today’s dollars because we discounted it

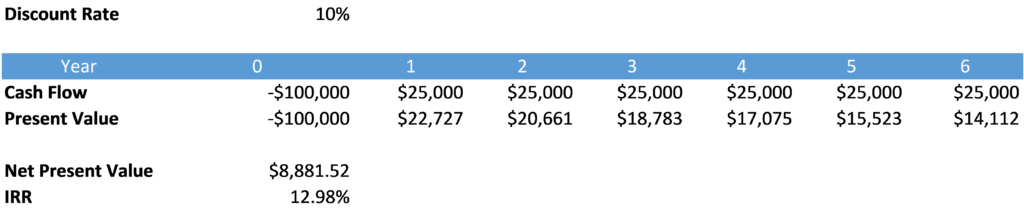

In year 1, you purchase an investment for $100,000 and, at the end of every year, you receive $25,000 in cash flow. The discount rate is 10%, so you discount each cash flow by 10%. The longer it takes to receive a cash flow, the larger it is discounted. Hence, year 6 has the smallest present value cash flow ($14,112). To find NPV, you add up all present value cash flows ($108,881.52) and subtract by your initial investment ($100,000).

Cumulative Discounted Cash Flow – Initial Investment = NPV

$108,881.52 – $100,00 = $8,881.52.

In the above example, if you were to calculate NPV and use the IRR of 12.98% for the discount rate, you would get an NPV of 0. If NPV is 0, then you are indifferent on the decision of investing in the project or not.

Comparing IRR and Equity Multiple

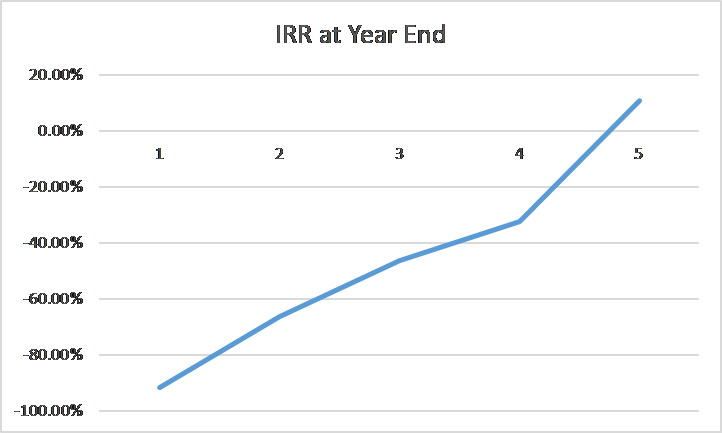

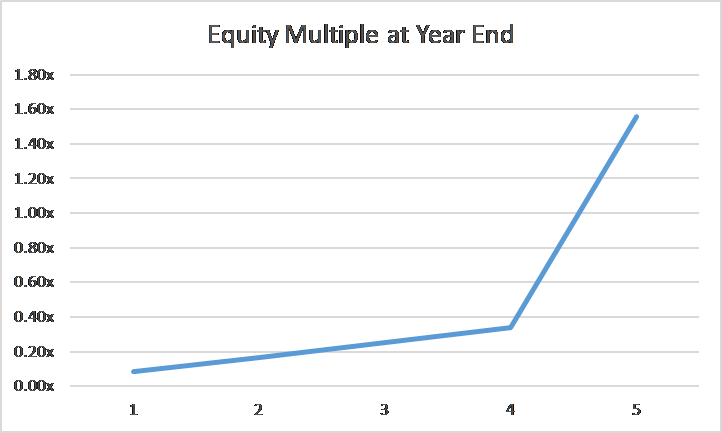

In the investment example below, you invest 9 million dollars in a multifamily property. Note that the IRR is negative each year until the initial investment, 9 million dollars, is returned. We should also note that the IRR and the Equity Multiple both become positive in year 5 (the disposition year).

The IRR crosses over 0% in year 5 and the Equity Multiple crosses over 1.0x in year 5.

Note on Accurately modeling IRR in Real Estate Investments

Whenever you have the opportunity, use monthly cash flows rather than the sum of cash flows over a year to find IRR. By using monthly cash flows you will get a more accurate IRR because you discount the monthly cash flow every month rather than discounting the total yearly cash flow once a year.