Introduction to Cap Rates in Real Estate

Basics of Real Estate Capitalization Rate (usually called a Cap Rate)?

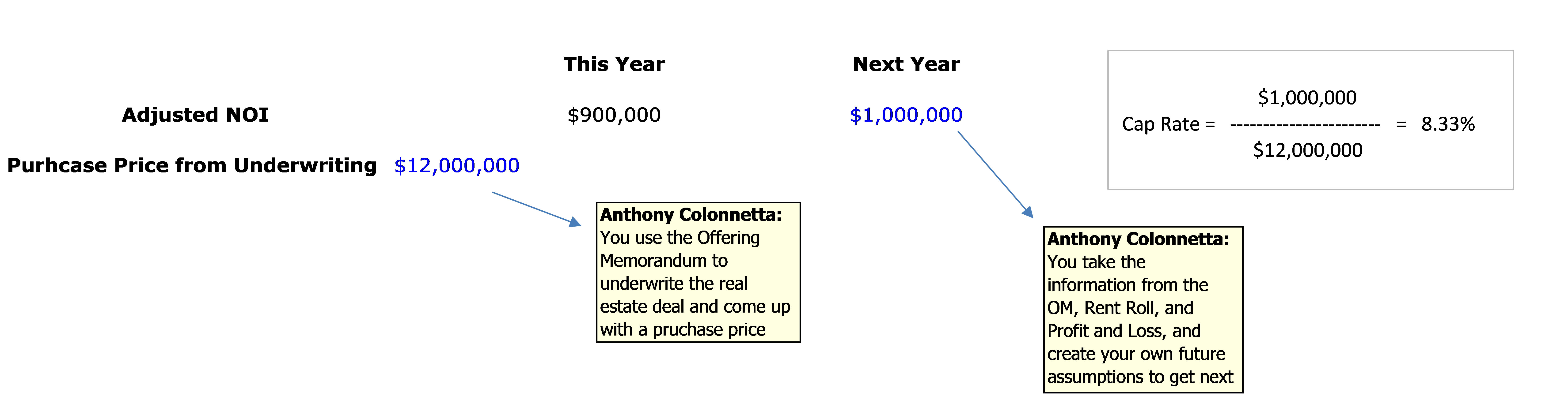

A Cap Rate reflects the desirability of a properties cash flow stream. You find a properties cap rate by finding its next years Stabilized Adjusted Net Operating Income and dividing by the purchase price of the property.

Cap Rate % = Next Years Stabilized Adjusted NOI / Purchase Price

Adjusted Net Operating Income is the Net Operating Income (NOI) subtracted by capital and leasing costs like Commissions, Tennant Improvements, and Capital Expenditure Reserves.

Adjusted NOI = NOI – Capital and Leasing Costs (like Tennant Improvements, Leasing Commissions, Capital Expenditure Reserves, etc)

Cap Rate and Valuation Multiples

If we took the above examples cap rate of 8.33%, we could derive that cap rate into a valuation multiple of 12x. 1/8.33% = 12x. If the cap rate dropped to 5%, the valuation multiple would be 1/5% = 25x. Hence, the assets cap rate and valuation multiples are inverses of each other.

The relationship between cap rates and property values are similar to bond interest rates and bond prices. In a vacuum, if a properties cap rate increases, the properties value decreases.

Components of a Cap Rate

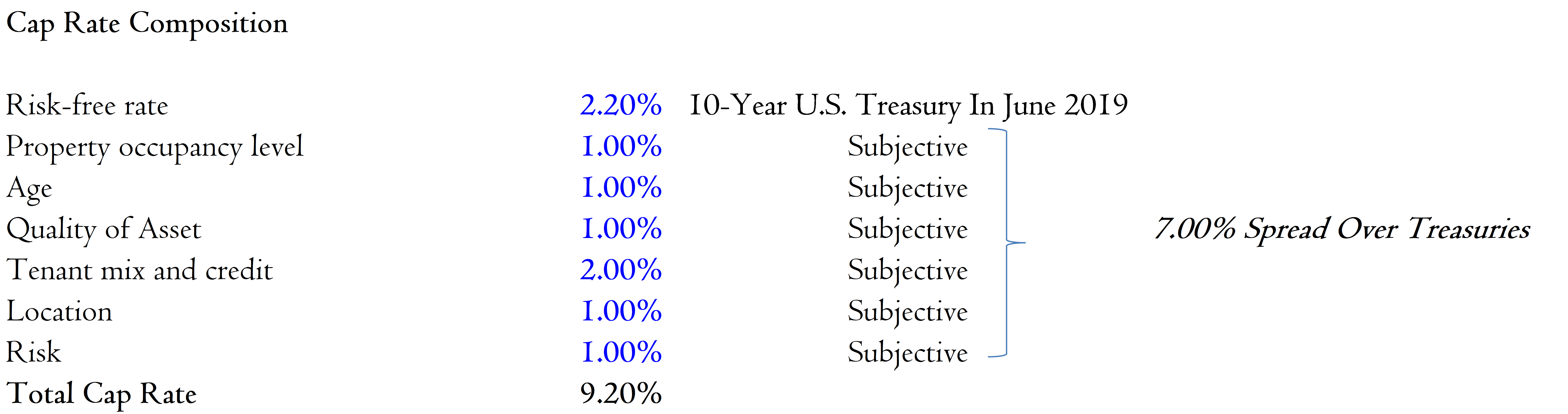

The actual cap rate for a specific property is based on:

- A risk-free rate (U.S. Treasury Bond)

- Properties occupancy level

- Age of property

- Quality of the property

- Tennant base (what kind of residents are living there?)

- How are the economy and location

- Level of risk associated with the asset

- Accuracy and reliability of market data and what have similar real estate properties been trading at

- Will the property be a desirable asset in the future

If the 10-Year U.S. Treasury is 2.20% and the property trades at a 9.20% cap rate, that means there is a 700 basis point spread to Treasuries (a 7% premium).

Projecting Future and Exit Cap Rates

If a cap rate today is a risk-free rate plus a spread that reflects risk (risk premium), then a future cap rate is a forward estimate of what the risk-free rate will be in the future when you sell the asset plus the future risk premium.

If you decide to sell the asset in 5 years you will have to compute an exit cap rate. You multiply your exit cap rate by your projected year 6 adjusted NOI to see what you will sell the asset for in year 5.

- As a building/asset ages, it doesn’t become the best asset in town. Hence the cap rate increases.

Where can you find data on cap rates?

- Real Estate Alert

- Investment sales brokerage packages

- Real estate company research reports (Marcus and Millichap, CBRE, HFF, etc)

- Costar/LoopNet