With the goal of investing in a multifamily asset within a 5-7-year term, it is better to look into metro market metrics to pick a multifamily real estate location (and not submarket metrics) because there is such little variance between a submarket and metro in a 5-7-year period for multifamily. Once the desired metro is chosen and deals in that metro are being evaluated, the submarket criteria will then go in to play.

Multifamily Location Criteria – MSA

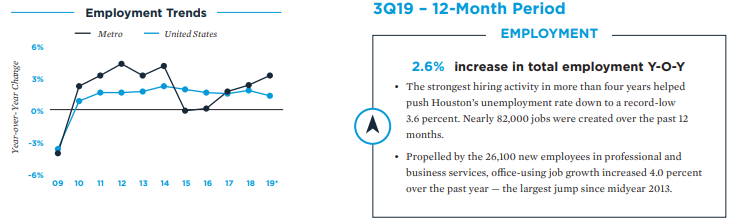

• Higher job growth than the United States average

• Higher population growth than the United States average

• A higher percentage of citizens with a bachelor degree than the United States

• Positive rent growth

Multifamily Location Criteria – Submarket

• Average household income in a 1-mile radius of the property is 3x the average rent of asset

• A majority of the submarket rents instead of buys

• Above-average schools in the area

Houston MSA

Employment Trends

Multifamily Rent Trends

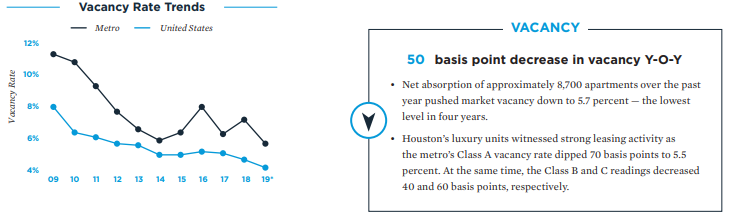

Multifamily Vacancy Trends

Population Growth

After you decide on your desired multifamily real estate location you want to invest, you then focus on what your multifamily building criteria.